Pirate Treasure. Startup IPOs. 3X bonuses. Scratch-off lotteries. Hypersonic stocks. Marrying royalty.

We think up clever windfalls to rationalize our dreams. We can own handmade sports cars, azure watered tropical islands, and concealed safes reeking of hundred dollar bills. It helps us believe we can live a Hollywood lifestyle if only we make the right bet.

Get-rich-quick schemes poison our ambition and self control. They trade a million pennies for a swipe at one $10,000 bill. While chasing extraordinary events we miss out on concrete opportunities for building wealth.

None of us will wake tomorrow morning laying in a pile of gold doubloons. None of us will cash a ten million dollar check, or ring the New York Stock Exchange bell. Not even if you fall to your knees and whisper “pretty please.”

I still see friends trying to build a magical money fountain in their spare bedrooms. Our engineer’s inclination to cleverness can distract us from a deliberate approach to goals. Our addition of engineering skill to the equation makes long shots seem more reachable. Making millions at a software startup seems more likely when you’re a software expert. If only you join the right company with the right idea at the right time, you’ll get rich at the IPO. We want to believe that our skills will magnify our chances of a jackpot. Maybe we can engineer some luck!

It’s a trap magnified by our poor grasp on who is rich and how they got there. We think of wealth like the Robb Report does: ostentatious homes, slick gizmos, and over-the-top vacations. For an engineer, luck is the only visible path to 300 foot yachts and six-figure dirigible ski trips in the Andes. Our vision confuses spectacle and splurging with real wealth.

Yachts large enough for Forbes to report are the product of ludicrous spending. Submariner watches look impressive, but they don’t pay dividends. Luxury only tells us about spending, not the path to riches.

Spending money on fancy stuff proves nothing. Paying for luxury with debt takes no special talent. Extravagance doesn’t confirm riches any more than a snobby attitude and a prejudice against hot dogs for lunch. Unsustainable spending surely leads to poverty and frowning bankers, but there is no easy trick to know it when we see it.

From the outside we can’t tell if an autonomous two-masted schooner is worth 1% or 400% of the owner's net worth. A crazy boat that makes up less than 1% of your net worth might make sense. A boat that makes up the majority of someone’s wealth belongs to a fool. Why benchmark our level of success against a situation that might be idiotic?

We need a better measure of wealth than fancy crap. You can’t plot your course to riches without a goal and a tool to measure progress. Discussion won’t mean much without a good metric to judge against.

Measuring Wealth

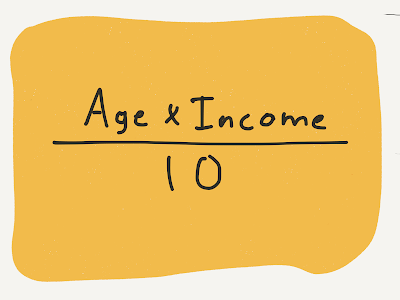

My preferred measure of wealth compares your resources to your income. It doesn’t care what your neighbors or colleagues own or do. It doesn’t care if you ride a dirt-crusted Huffy mountain bike or a Ferrari F12berlinetta. Do you get your clothes at Walmart? Or do you only go to a boutique where they taylor each garment? This measure doesn’t care.I love the The Millionaire Next Door. It’s my favorite book about wealth. It proposes a wealth benchmark of ten percent of your annual income multiplied by your age. If your net worth is at that level or above, you have what they consider the expected level of wealth. If you build a net worth that is above twice that level, you are what the book calls a prodigious accumulator of wealth.

Using this measure requires only honesty and math. The terms are simple. Net worth means assets minus liabilities (debt). Bank accounts, stock, mutual funds, ETFs, real estate, and cars are all assets. Credit cards, mortgages, student loans, and car loans are liabilities. Don’t cheat. Never list consumer goods as an asset: most clothing, electronics, and furniture have little value after purchase.

Your income should include your salary, any supplements you get from relatives, and any income that comes from investments like rental property.

More than the superficial signs of wealth involving fashion labels and cars, this measure reveals what proportion of your own income you hold on to and grow. It measures your savings and investment efficiency rather than your appearance.

Put another way, it measures how much of the income flowing through your hands stays in your pockets. A river of wealth flows through our bank accounts. If we can divert enough of the river’s current into a reservoir, we will naturally grow wealthy. If we allow our river of income to entirely flow into the sea, we’ll always depend on it.

Does that excite you? It should. No matter what happens in the external world, we can control ourselves. We don’t need much luck to accomplish that. Just habits.

Wealth achieved through our own behavior may seem disappointing. It’s much less convenient than finding a Liberty Head Nickel stuck to your Chucks. Changing your behavior requires tradeoffs and long-term thinking. It may mean sacrificing your desires now to have wealth later.

But have hope. Wealth is a skill. Anyone with more than a poverty-level income can practice it.

Paths from Zero to Wealth

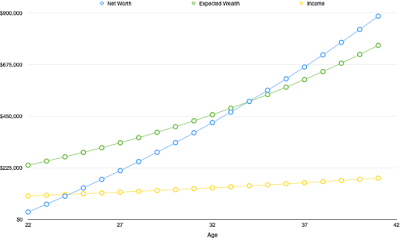

If you graduate college at age 22 and have an income of 100000, our formula expects your net worth to land at $220000. An impressive and unlikely sum for a recent graduate.My eyes bugged out when I first did this calculation for myself a dozen years ago. I was shocked. I was a few years out of school, in a good job and contributing to a 401k and Roth IRA. Yet on this measure of wealth I fell far behind the curve. I was earning a C or a D grade on wealth, and I itched to improve it.

Consider how you might get from zero to wealth over the ten years. Let’s still assuming an income $100,000. And to keep it easy, let’s also assume that your income and the value of our investments didn’t increase. How would you become wealthy within that decade?

The expected net worth at age 32 is $320,000. To get there from a net worth of zero implies that you saved $32,000 each year. That's a savings rate of 32% of pretax income, or around a 44% savings rate of after tax income (assuming a 28% tax rate). Every month over 10 years, you must drop $2,666 into your piggy bank.

|

| Building Wealth from Zero with $100K Income (32% pretax savings) |

What if you procrastinate the wealth question until you’re 30? I know engineers older than that who have saved very little. For this case let's again assume that from 30 to 40 years old you earn $100,000 per year. Your expected wealth level is $300,000 at 30.

If you have very few assets at this point and want wealth by your 40th birthday, you better get busy. You now have to save $40,000 per year over the next ten years, 40% of your pre-tax income, or about 56% after taxes (assuming a .28 tax rate). You’d need $3,333 per month, 25% more than you needed at 22, and 2.2 times maximum you can contribute to a 401k pre-tax.

The delay stings. If you’re used to a monstrous income-devouring lifestyle, it cuts deep. The earlier you start building your net worth, the gentler the climb to the top. And if you’d like to qualify as a prodigious accumulator of wealth, you need to double these numbers.

Once you reach your target level of wealth, maintaining it won’t hurt as much: you just need to preserve 10 or 20% of your income each year.

Hopefully you noticed some assumptions in my math. The income remains consistent over ten years, and the savings has no growth. If you invest wisely, your net worth will grow faster than your savings rate. If your salary grows, so too will your expected net worth.

Unexpected Implications

The wealth formula leaves clues about money management. Wealth isn’t absolute. Wealth only has meaning relative to your age and income.You can be wealthier on this scale than a neighbor who has a much higher net worth.Wealth does not necessarily require more income. Controlling spending is just as important. Wealth might mean moving where the cost of living is less. It might mean spending less on things we don’t care about. Or it might mean making good investments. Our wealth isn’t one-dimensional, it’s a landscape of possibilities.

This story also tells us that as we grow older, we require a higher net worth to keep the same level of wealth. Does this represent the cost of healthcare as we age? The prospect of retirement? Inflation? The expectation of the growth of our investments? All of these interpretations seem fair.

As our income grows with raises, promotions, and income-producing investments, our wealth is also expected to grow in turn. Each salary bump requires another step up in the net worth we need to be considered wealthy. Those bumps are also expected to continue to expand our wealth at ten to twenty percent of our age per year. Those consequence almost demand that we invest a large part of our raises instead of spending them.

|

| Building Wealth With 3% Annual Income Growth (40% pretax savings) |

If you repeat the calculations for a prodigious accumulator of wealth (20% of your annual income times age), you will notice that the pre-tax savings rate over the ten years from age 22 to 32 is 64%. After taxes that leaves very little money (about 12% with the same assumptions). A prodigious accumulator of wealth will almost certainly need excellent investment growth to supplement their income. Saving 40% of your pre-tax income still works with enough time though:

|

| Building Prodigious Wealth by Saving 32% Pretax |

Practicalities of Building Wealth

More than twelve years after reading The Millionaire Next Door, I have made reasonable progress against its measure of wealth. And I did it despite working at a failed startup that resulted in a more than 50% paycut for a year. Am I rich when compared to the people in magazines and TV? Not even close. But against my own income and my financial needs, I am doing well.A few key decisions helped me grow my net worth:

- automated savings and investment in index funds

- buying and holding on to investments instead of selling when the markets did poorly

- buying and sticking with a “starter home” even while my income doubled

- refinancing my home for a lower interest rate and additional 30 years to reduce expenses

- owning and sticking with a reliable car for the long term

Obviously this isn’t investment advice. You should make your own calculations and talk with an accountant or other professional before making any changes. For instance, buying a house can be a really dumb idea in some parts of the country.

Automated savings and investment let you grow your net worth without having to think. A 401k or Roth 401k let you easily invest in the stock market with every paycheck. Often your employer will even chip in extra money for you. While they might not be perfect for every situation, they are easy to use. If a 401k isn’t enough, or you prefer a more liquid place for your money, many brokerage firms can periodically move money into an investment account from your bank account.

Holding on to investments saves you taxes (in the case of non-retirement accounts) and transaction fees. It also discourages you from trying to time the market or chase higher performing investments.

Buying and sticking with my “starter” home helped me because my income has grown while my mortgage has remained the same. I can’t say that buying a home is right for everybody, but it has helped my situation. The cost of Austin housing has gone up dramatically. If I had sold this home and bought a new one, not only would it likely have meant a higher mortgage and property tax, it also would have cost me 6% or more in realtor and other transaction fees. If I had rented an apartment, I would probably now be paying more in rent than the cost of my mortgage, insurance, and property tax combined.

One caveat: homes aren’t a great place to store wealth. They aren’t very liquid in poor economic times — more expensive homes become especially difficult to sell. Even if you do sell your home at the right time, where do you plan to live next? Few people manage to do more than roll the sale of one house into the purchase of the next.

Selling my fun but unreliable Jetta and sticking with my reliable used Honda for years has let me save lots of money by not encouraging me treat my car like a status symbol. Also the repairs, insurance, tires, and oil are all much cheaper.

If you are going to do one thing today to get started, calculate your current net worth. See how you compare the wealth formula. Just knowing where you stand can feel motivating. I suggest using Personal Capital to track your investments over time, and Mint for monitoring your spending and current net worth.

†Moving Average Inc. is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com. Buying items through this link helps sustain my outrageous reading habit and is much appreciated!